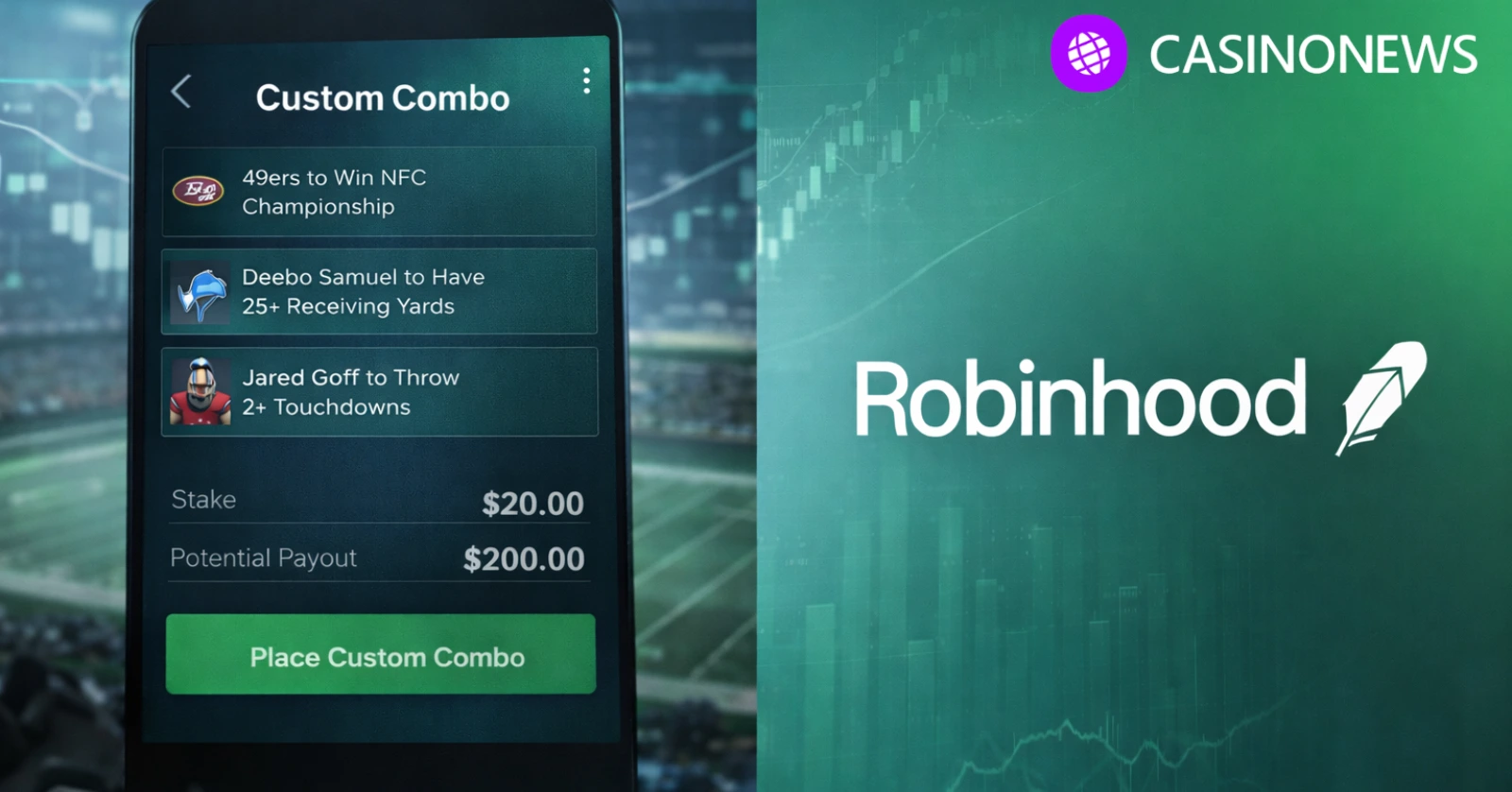

Robinhood has rolled out a new feature called Custom Combos for its sports prediction markets, allowing users to bundle multiple event outcomes into a single contract. The rollout comes as interest in prediction markets grows alongside major sporting events such as the NFL playoffs and other professional leagues. The company said Custom Combos will let users combine up to 10 outcomes into a single contract.

The launch marks a strategic move for Robinhood’s prediction market product, which has emerged as one of the platform’s fastest-growing revenue lines. Custom Combos extend beyond preset bundles by offering traders the ability to construct multi-leg positions that link outcomes across teams, games, or events. This development aligns Robinhood with broader market demand for features similar to parlays in traditional sports wagering, but structured within the mechanics of a regulated prediction market.

Custom combos introduce multi-outcome sports contracts

Custom Combos allow users to assemble combinations of outcomes for up to 10 events. For example, a trader could tie together a team to win its game with a player hitting a performance milestone and other events resulting in a single transaction. All legs must resolve favorably for the contract to pay out.

Robinhood executives have said this feature is being introduced ahead of peak demand periods like the NFL playoffs, when traders typically seek more ways to express complex views on game outcomes. The company’s prediction markets have seen rapid adoption, and sports, especially football, have consistently driven a significant portion of trading volume.

The feature’s mechanics rely on how Robinhood structures prediction markets contracts, which operate differently from sportsbook parlays. Rather than traditional fixed odds, the Custom Combos framework prices combinations in a way consistent with the underlying market mechanics available on the platform.

Prediction markets emerge as a key growth driver

Robinhood’s prediction markets business has grown quickly since its introduction, with company executives boasting strong user engagement and trading volume. Custom Combos are being positioned as a natural evolution of that product, offering more sophisticated trading tools to experienced traders while attracting new users interested in multi-outcome strategies.

Industry observers have noted that the introduction of combination contracts could broaden Robinhood’s appeal, particularly among users accustomed to sportsbook parlays and multi-leg betting. In some markets, traditional parlays are a core revenue driver for sportsbooks, and Robinhood’s Custom Combos aim to capture similar engagement while remaining within the regulatory and structural frameworks allowed for prediction markets.

Robinhood has framed Custom Combos as distinct from traditional parlay bets, emphasizing that the contracts remain prediction market products rather than typical sports bets. The company has sought to maintain this distinction amid ongoing debate about how new wagering products should be regulated, particularly in the context of federal and state oversight of financial instruments versus gambling.

Competition intensifies across prediction market platforms

The launch comes at a time of intensifying competition in the prediction market space, where providers are experimenting with features to attract bettors and improve user engagement. Other platforms have introduced combination and preset bundles to compete with conventional sportsbooks and to respond to trader demand for more flexible multi-event positions.

Robinhood’s move places it alongside competitors that are seeking to bridge the gap between prediction market mechanics and the user experience of traditional sports betting. By offering a structured way to link multiple outcomes, Robinhood is attempting to reduce friction for traders who might otherwise view standalone contracts as too limited.

Regulatory pressure builds around betting-style features

Prediction markets operate under a different regulatory regime than most licensed sportsbooks, and Custom Combos raise questions about how new betting-like features fit within that framework. Robinhood and similar platforms argue that prediction markets facilitate information for market discovery and financial participation rather than conventional gambling. Critics, including state regulators in some jurisdictions, counter that products resembling parlays may fall under gambling laws regardless of structure.

Robinhood’s emphasis on maintaining prediction markets as distinct financial products may influence how Custom Combos are treated by regulators. The debate over classification, oversight, and permissible features is likely to continue as such offerings evolve and grow in popularity.

Robinhood targets broader rollout beyond football

Robinhood has signaled that Custom Combos will initially focus on professional football outcomes, with potential expansion into other sports and event types over time. The company’s broader strategy appears to be building out a diverse suite of prediction market tools to complement its core brokerage services, attracting users who engage with both financial markets and event outcomes.

As the prediction market segment grows, Custom Combos could become a central feature for Robinhood’s sports product, potentially shaping how multi-outcome prediction contracts are priced and traded. Increased user adoption and further product iteration may define the next phase of growth for the platform within the evolving intersection of financial trading and event prediction.