The UK gambling market ended 2025 with two stories running at once. Online slots kept climbing to new highs, while real-event betting and high-street betting shops moved the other way.

That split has been a consistent theme in recent coverage of UKGC press releases: slots continues to carry the online mix, while retail yield remains under pressure.

Slots keep growing, but long sessions fall

Online slots gross gambling yield rose 10% year-on-year to £788 million for October to December 2025. Spins increased 7% to 25.7 billion and average monthly active accounts grew 5% to 4.6 million.

At the same time, the number of slots sessions lasting longer than an hour dropped 16% to 8.9 million, while average session length fell by two minutes to 16 minutes. The commission also noted that some operators changed session-length methodology, which affects year-on-year comparisons for those measures.

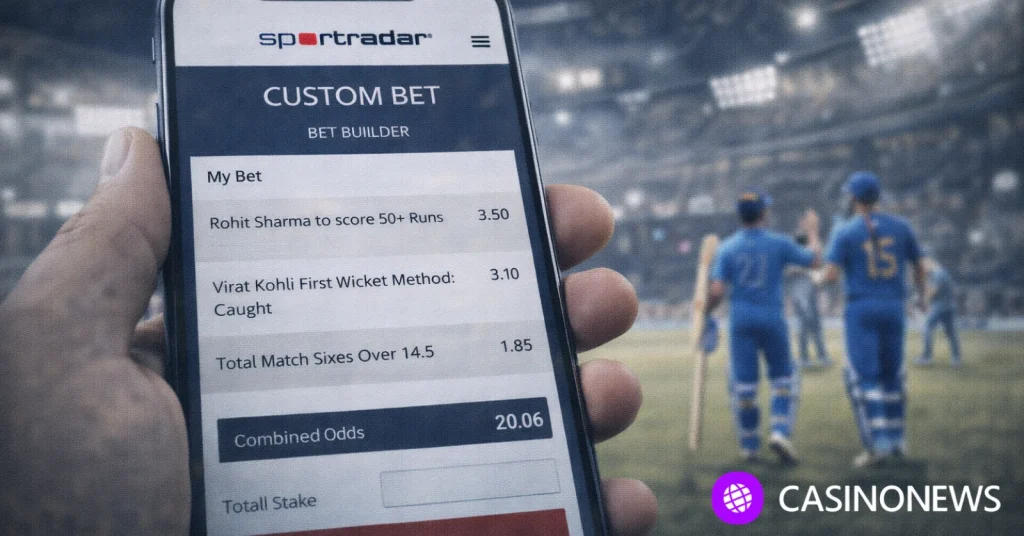

Sports betting drags on the online total

Total online GGY for the quarter slipped 2% year-on-year to £1.5 billion, even as total bets and spins rose 6% to 27.4 billion. Average monthly active accounts across online products fell 2% to 12.7 million.

The main driver was online real-event betting, where GGY fell 18% to £530 million. The number of bets dropped 6% and average monthly active accounts fell 7%, leaving slots as the clear growth engine in the mix.

Betting shops soften again as footfall shifts online

Retail betting premises reported GGY of £549 million, down 7% year-on-year, with total bets and spins down 1% to 3.1 billion. Over-the-counter GGY fell 12% in the quarter to £141 million, and self-service betting terminal GGY fell 15% to £130 million.

Machines remain the biggest retail volume line, but this data still points to a soft quarter across channels. The next read is whether sports betting rebounds around major fixtures, or whether the mix keeps shifting toward slots as the market adapts to tighter guardrails.