Polymarket has filed suit against Massachusetts in a new escalation of the state’s push against sports-linked prediction markets, arriving days after a judge reaffirmed a statewide order requiring Kalshi to block Massachusetts users from accessing sports markets.

The clash is becoming a test case for where state sports wagering laws stop and where federally regulated event contracts begin, with the Massachusetts proceedings now shaping how other jurisdictions frame their own actions.

Massachusetts doubles down on the geofencing order

On Feb. 6, a Massachusetts Superior Court judge ordered Kalshi to geoblock Massachusetts residents within 30 days while its appeal proceeds, reaffirming a path that began with a Jan. 20 preliminary injunction. The court also denied Kalshi’s request for an emergency stay.

The judge said Kalshi’s sports contracts were closer to gambling than financial trading and rejected the argument that federal oversight automatically strips states of authority to regulate sports wagering-like activity. Massachusetts users can no longer open new sports-related positions, although existing contracts are allowed to settle.

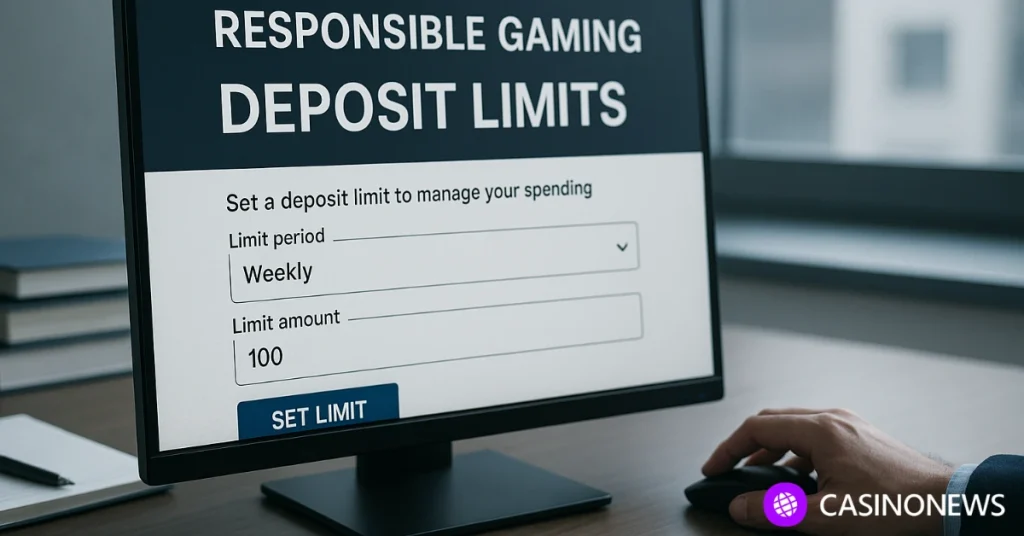

Licensing and age requirements are central to the state’s theory

Massachusetts Attorney General Andrea Joy Campbell’s position has been that Kalshi lacked the required state gaming license and did not follow consumer protection rules tied to legal sports betting. One of the practical flashpoints is age. Massachusetts sets 21 as the minimum for sports betting, while Kalshi’s product access has been framed around an 18+ model, widening the political and regulatory gap even before the legal questions are resolved.

That framing is important because it shifts the debate from abstract preemption theory to concrete state-policy outcomes: who can participate, under what safeguards, and with what enforcement tools.

Polymarket’s lawsuit adds another front to the same fight

Polymarket entering the Massachusetts arena matters even without any single detail deciding the case on its own. It signals that platforms see state-by-state pressure as an existential risk, not a manageable compliance nuisance.

The state cases also show a fast-hardening line: if judges treat sports event contracts as sports betting in practice, platforms will face the same patchwork that shaped early US sports wagering expansion, rather than a single national framework.

Massachusetts court rulings are starting to set the tone

The immediate business impact is simple: market access can be shut down on a state timetable. The larger impact is precedent. If Massachusetts succeeds in keeping sports contracts inside the state gambling perimeter, prediction markets will have to either narrow product scope, pursue state-by-state strategies, or accept ongoing litigation as the cost of operating.