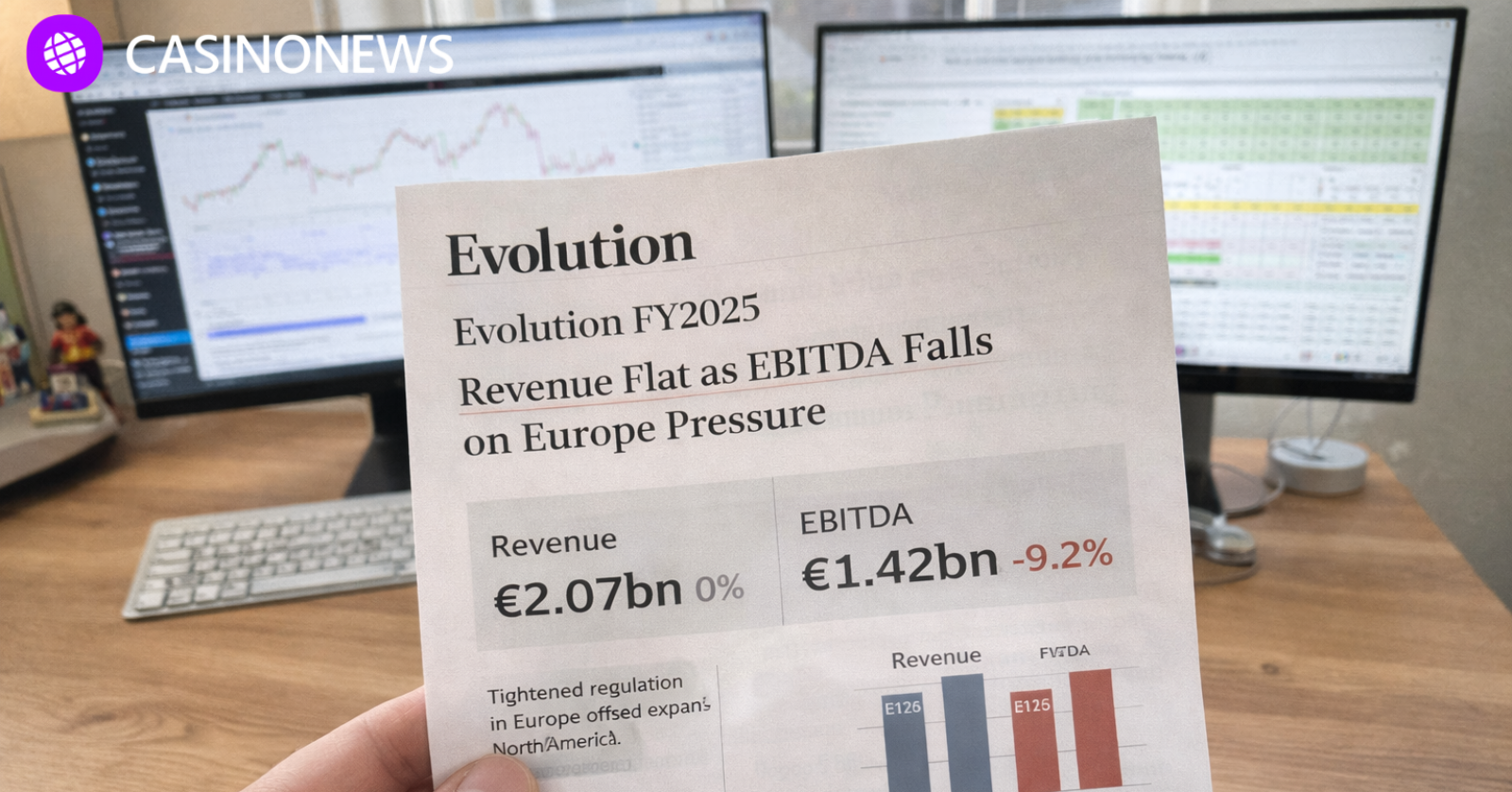

Evolution reported flat revenue growth for 2025 and a decline in profitability, as tighter regulation in Europe offset expansion in North America and other regions. The results point to a step down from the supplier’s historic margin peaks.

Full-year net revenue rose 0.2 percent to €2.07 billion. Fourth-quarter revenue fell 3.7 percent year on year to €514.2 million. On a constant-currency basis, the company said fourth-quarter revenue grew about 4.9 percent.

Profitability weakened across the year, with EBITDA down 9.2 percent to €1.42 billion and margins contracting across most measures.

Margin profile shifts lower as costs rise

Reported EBITDA margin fell to 66.9 percent from 70.5 percent in 2024. On an adjusted basis, EBITDA margin was 66.1 percent, down from 68.4 percent a year earlier.

Operating margin dropped to 59.4 percent from 64.1 percent. The decline reflects higher personnel costs and ongoing studio expansion. Headcount increased to 22,475 employees as the company continued to build capacity across multiple regions.

Adjusted EBITDA excludes €51.7 million tied to a reduction in earn-out liabilities, meaning reported profitability still benefited from accounting effects rather than purely operational gains.

Europe contracts as regulated mix rises

Europe remained Evolution’s largest market but continued to weaken in the fourth quarter. Revenue from European customers declined both sequentially and year on year.

Management cited unfavorable regulatory developments as the main driver. At the same time, the share of revenue coming from regulated markets rose to 47 percent in the fourth quarter, up from 41 percent a year earlier.

That mix shift supports long-term compliance goals but tends to compress margins. The company also continues to face uncertainty tied to its UK license review, leaving Europe as a key regulatory variable heading into 2026.

North America and emerging markets provide growth

North America continued to expand during the quarter, with the U.S. positioned as a central growth market. Evolution relaunched its Ezugi brand in New Jersey and announced a new studio in Grand Rapids to support operations in Michigan.

Live casino remains the company’s core segment, generating €1.77 billion in full-year revenue compared with €294 million from RNG products. The earnings profile still depends heavily on maintaining live-casino leadership as U.S. markets mature.

Asia showed sequential improvement in the fourth quarter, while Latin America delivered year-on-year gains despite quarter-to-quarter volatility. Africa and other markets also expanded, supporting geographic diversification beyond Europe.

Customer mix improves and capital returns continue

Customer concentration declined during the year. The five largest clients accounted for 39 percent of revenue, down from 46 percent in 2024. The largest single customer represented 12 percent.

Operating cash flow reached €1.26 billion. Evolution returned €572.5 million in dividends and repurchased €500.2 million in shares during the year.

The company ended 2025 with €818 million in cash and an equity ratio of 73.8 percent. The balance sheet leaves room for continued studio investment and potential acquisitions, including the pending Galaxy Gaming deal.

A new margin baseline emerges

Evolution enters 2026 with slower top-line growth and a lower margin profile than in prior years. The shift reflects higher regulated exposure, expanded studio capacity, and ongoing compliance costs.

The company’s scale, global studio network, and live-casino dominance remain intact. The central question for the coming year is whether margins stabilize around the mid-60 percent range or recover as scale efficiencies take hold.