Evolution’s Q4 2025 report landed as a mixed print. Margins stayed high, but the top line still came in light enough to push the stock lower, with shares down about 5% in early trading.

Management is leaning on a 2026 catalyst set, led by new Hasbro-branded launches and a renewed push in the Americas.

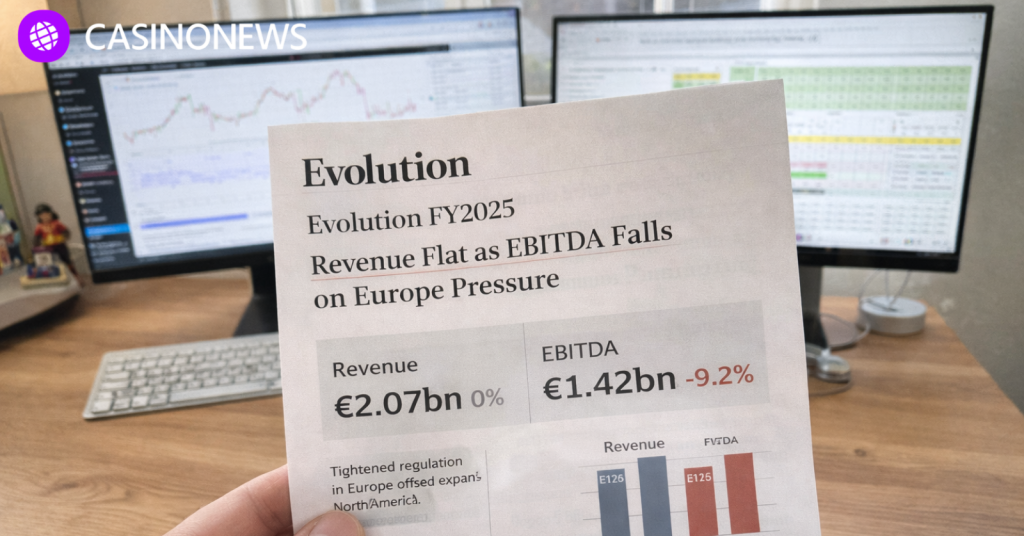

Numbers missed, even with a 66% margin

Evolution reported Q4 net revenue of €514.2 million, down 3.7% year over year. Adjusted EBITDA fell 6.1% to €341.5 million, for an adjusted EBITDA margin of 66.4%. Earnings per share were €1.54.

Coverage of the results pointed to revenue and adjusted EBITDA landing slightly below consensus, even as EPS beat some forecasts. That gap between a strong margin profile and a soft quarter helped drive the negative share reaction.

Europe weakness and the UK review stay in focus

In its CEO comments, Evolution said Asia, North America, Latin America, and Africa all performed well in the quarter, but Europe was “not good,” citing unfavorable regulatory movements and warning that regulated markets are “losing ground.” The practical issue is channelization, and whether play stays in licensed options.

In the Q4 presentation deck, Evolution also said it had “no news” from the UK Gambling Commission. That keeps a regulatory overhang in place while the company argues it has tightened ring-fencing controls.

Monopoly titles and the Galaxy timeline shape 2026

Evolution’s Hasbro partnership, announced in 2025, is now moving into delivery. The supplier has said titles including Game Night, MONOPOLY Filthy Rich, and MONOPOLY Roulette will start rolling out from January 2026, alongside RNG launches. In January, Evolution said it plans 119 scheduled releases across live and RNG for 2026.

Another investor watchpoint is the pending Galaxy Gaming acquisition. The merger agreement outside date has been extended to July 17, 2026, giving the buyer more time to clear approvals and close.