On Super Bowl week, DraftKings sportsbook director Johnny Avello described a shift he has watched accelerate in real time. The “big game” used to be mostly point spread, moneyline, and total. Now it is a prop-led menu built to keep customers engaged from kickoff to the final snap.

That change is happening at record scale. The American Gaming Association estimated $1.76 billion would be wagered legally on Super Bowl LX, reflecting how much of the action has moved into regulated mobile markets.

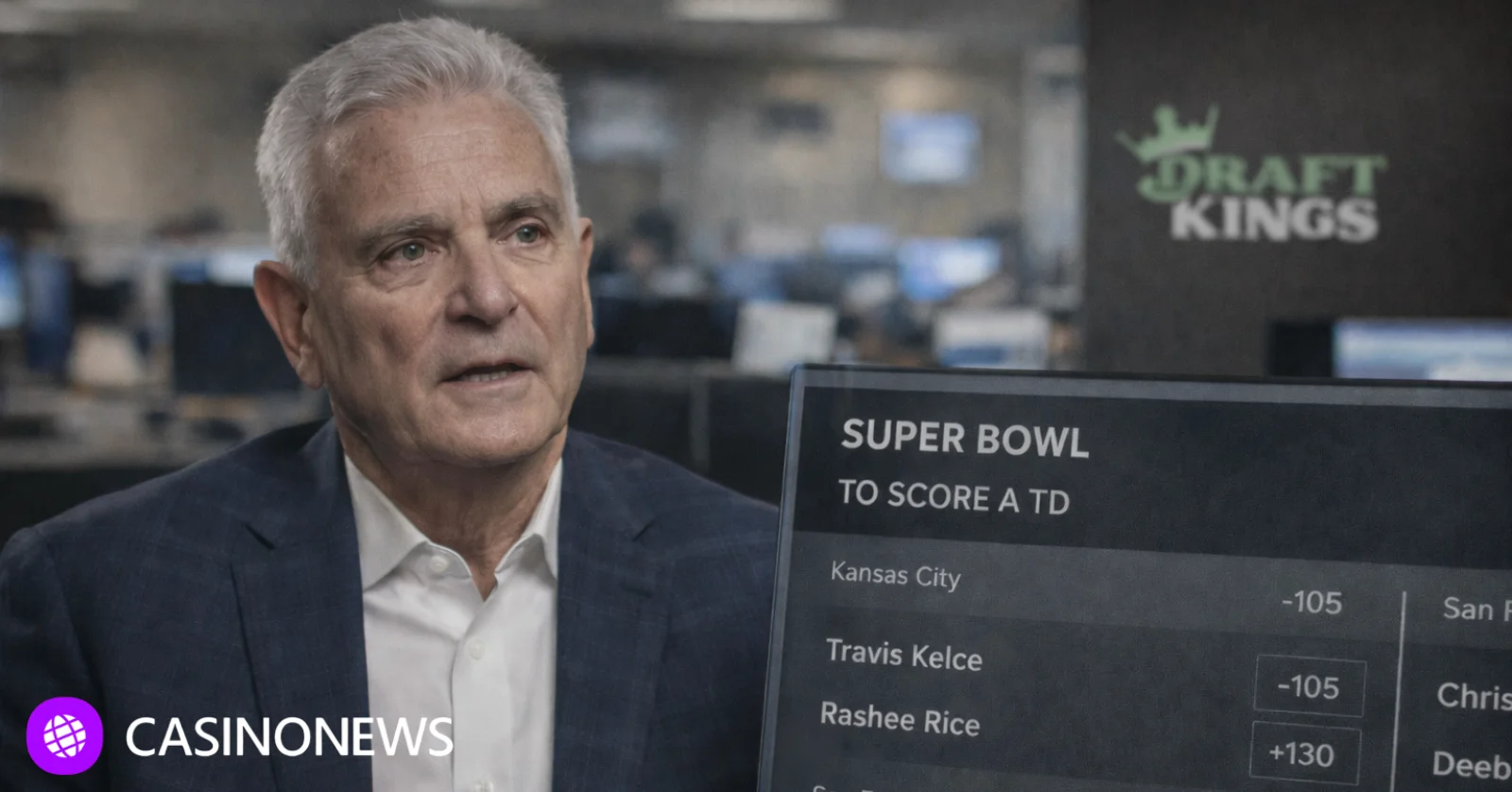

Touchdown props turned the game into hundreds of smaller markets

Avello said the fastest-growing prop area has been touchdown scorer markets. He told reporters that touchdown props have expanded well beyond “first scorer” into anytime and multi-touchdown options, and that this segment has been one of the biggest growth engines in recent years.

The broader point is product depth. Avello also pointed to the rise of more granular offerings, including wagers tied to play-level or player-level outcomes that sit alongside classic Super Bowl novelty props.

Mobile access changed behavior and raised the operational stakes

Avello contrasted the old Las Vegas-centered Super Bowl with today’s national footprint, where DraftKings can take action across dozens of states and support a much larger betting menu. In his view, the scale advantage now comes from distribution and offerings, not just a destination weekend.

Other coverage of Super Bowl LX has landed on the same practical takeaway: prop volume changes what books need from the game result. ESPN noted sportsbooks were watching a relatively low total and that prop-heavy action can shape liability in ways the spread alone does not. Avello similarly said totals often skew toward over money, which can leave books needing the under when limits rise.