NBA Commissioner Adam Silver said the league views prediction markets as a form of sports betting, placing them under the same integrity framework that governs licensed sportsbooks. His comments come as prediction market platforms push deeper into the professional sports ecosystem.

Speaking around All-Star Weekend, Silver also downplayed concerns about Giannis Antetokounmpo’s investment in Kalshi. He described the stake as small enough to fall within existing league rules.

The remarks land at a time when courts, regulators, and leagues are all grappling with how prediction markets should be classified and supervised.

Silver places prediction markets under sportsbook rules

Silver said the NBA is treating prediction markets “essentially” the same as sports betting companies. That stance places the platforms within the league’s existing integrity and compliance structure.

He noted that the legal status of prediction markets will likely be determined by courts and Congress. The issue centers on whether the products fall under federal commodities law or state gambling regulation.

Silver also pointed to the scale of global wagering on NBA games. He said the league is dealing with betting activity across dozens of U.S. states and more than 80 international jurisdictions, increasing the need for consistent oversight.

Giannis investment seen as within league limits

Silver addressed Antetokounmpo’s investment in Kalshi, calling it “minuscule.” He said the stake is well below the one percent ownership threshold allowed under the collective bargaining agreement.

League rules permit players to hold small investments in sports betting companies. Silver indicated the transaction did not raise compliance concerns under those guidelines.

The issue drew attention because it connected an active NBA star to a company at the center of ongoing regulatory and legal disputes.

Prediction market executives appear at league summit

Silver’s caution comes even as prediction market executives are being included in industry forums tied to major leagues. Leaders from Kalshi and Polymarket took part in a prediction markets panel during the NBA’s All-Star Tech Summit.

The closed-door event also included executives from major sportsbooks, media companies, and technology firms. The setting placed prediction market operators alongside traditional betting and sports business leaders.

That overlap reflects the current industry moment. Prediction markets are gaining commercial visibility while their legal status remains contested.

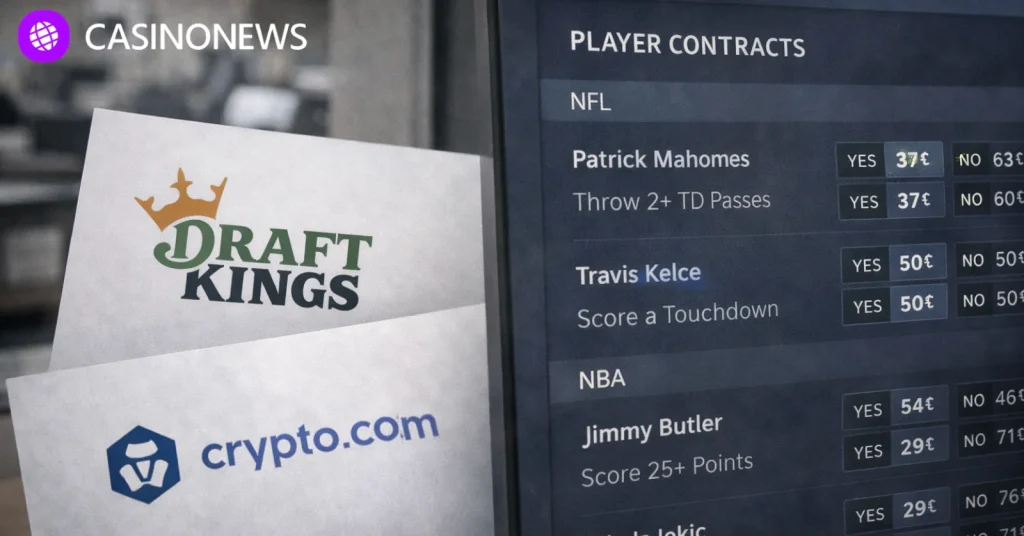

Other leagues split between caution and commercial deals

The NFL has outlined concerns about prediction markets while leaving the door open to future engagement. League officials have said they want clearer regulations and outcomes from ongoing litigation before taking a commercial position.

Major League Baseball has taken a more flexible approach. After warning players about prediction market involvement, the league has indicated it could consider commercial relationships depending on regulatory developments.

The NHL and MLS have moved further. Both leagues have signed partnerships with prediction market platforms, framing the deals as fan-engagement tools and a way to influence contract design.

Integrity concerns remain central to league positions

Silver’s comments come during a period of heightened scrutiny around gambling-related investigations. The NBA has dealt with several cases tied to suspicious betting activity and alleged insider information.

The league has not connected those matters directly to prediction markets. Still, the broader enforcement backdrop reinforces the emphasis on integrity controls and regulatory clarity.

Across the major leagues, the dividing line is not product mechanics but governance. The key question is whether prediction markets should operate under the same integrity protocols as sportsbooks when they offer contracts tied to game outcomes.

For now, the NBA is signaling an oversight-first stance, even as parts of the sports industry experiment with commercial partnerships.